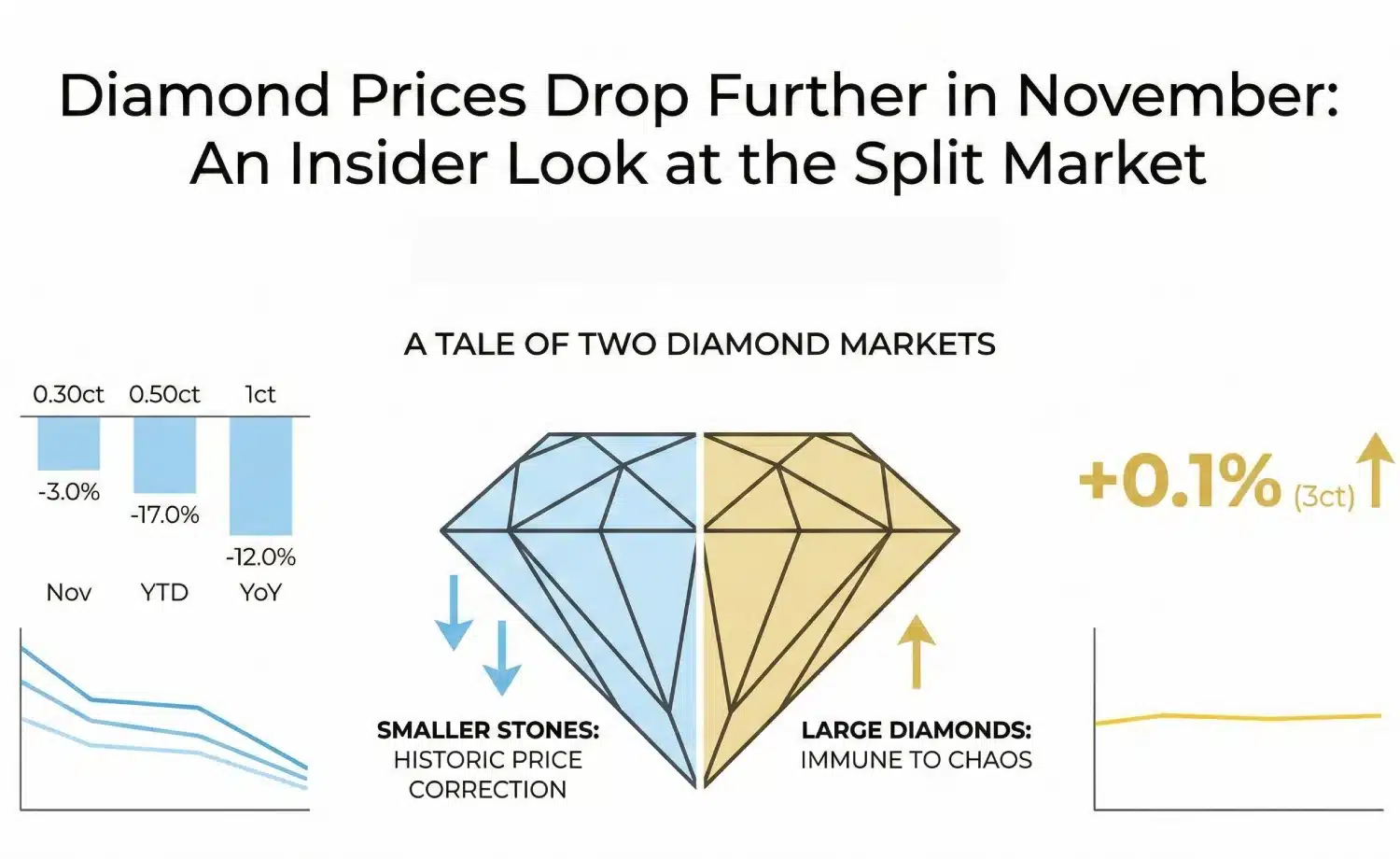

Diamond prices continued to fall for smaller stones in November, with the 0.50-carat category now down a staggering 21% for the year, while large 3-carat diamonds remained stable, rising by 0.1%.

I’m Mehedi, and the story we’ve been tracking all year is becoming crystal clear: we are in a tale of two diamond markets. On one side, you have the world of large, investment-grade diamonds holding steady, almost immune to the chaos.

On the other, you have the commercial market for smaller stones—the very diamonds most people buy—which is in the middle of a historic price correction.

As we head into the peak holiday season, this trend is creating huge challenges for the industry but massive opportunities for savvy buyers. We’re going to break down the latest data from Rapaport, look at the graphs that tell the story in stark detail, and give you the action plan you need to navigate this market with confidence.

The Big Picture: A Market Divided

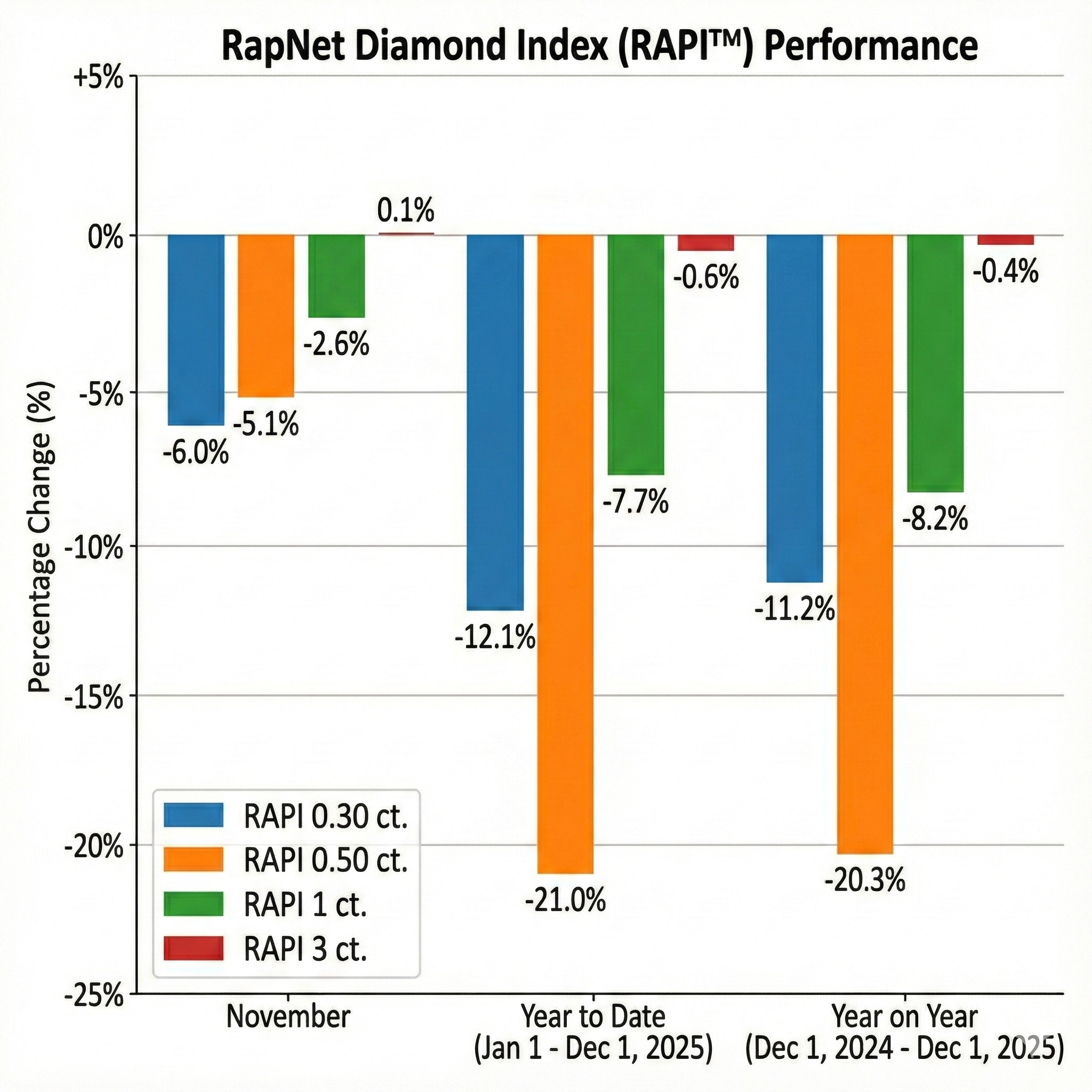

To truly grasp what’s happening, you need to look at the numbers. The latest performance data for the RapNet Diamond Index (RAPI™) paints a powerful picture of this deep split in the market.

Analyzing the November 2025 RAPI Performance

The bar chart below from Rapaport is the most important visual you need to see. It doesn’t just show a single snapshot; it provides a comprehensive overview of the market’s health from three crucial perspectives: the most recent monthly change (November), the change for the entire year so far (Year to Date), and the change compared to this same time last year (Year on Year).

The Shocking Year-to-Date Numbers

While the monthly numbers are important, the year-to-date figures are what truly reveal the depth of this trend. I’ve pulled the most critical data from that chart into a simple table so you can see the story clearly.

| Diamond Size | November Change | Year-to-Date Change |

| 0.30 Carat | -6.0% | -12.1% |

| 0.50 Carat | -5.1% | -21.0% |

| 1.00 Carat | -2.6% | -7.7% |

| 3.00 Carat | +0.1% | -0.6% |

The Insider’s Take on the Data

Let me be direct: these numbers are undeniable and dramatic. The -21.0% drop in the 0.50-carat category for the year is not a minor fluctuation; it is a deep and significant market correction. This data confirms that the commercial market for diamonds under 2 carats is under intense pressure.

So what does this mean? It means the high-end market for 3-carat and larger diamonds, which has only fallen by a negligible -0.6% all year, is effectively weathering the storm and operating in a completely different reality.

The value of those large stones is holding firm, while the prices for the most common diamond sizes are falling to levels we haven’t seen in a very long time.

The Story of the Month: A Steady Slide

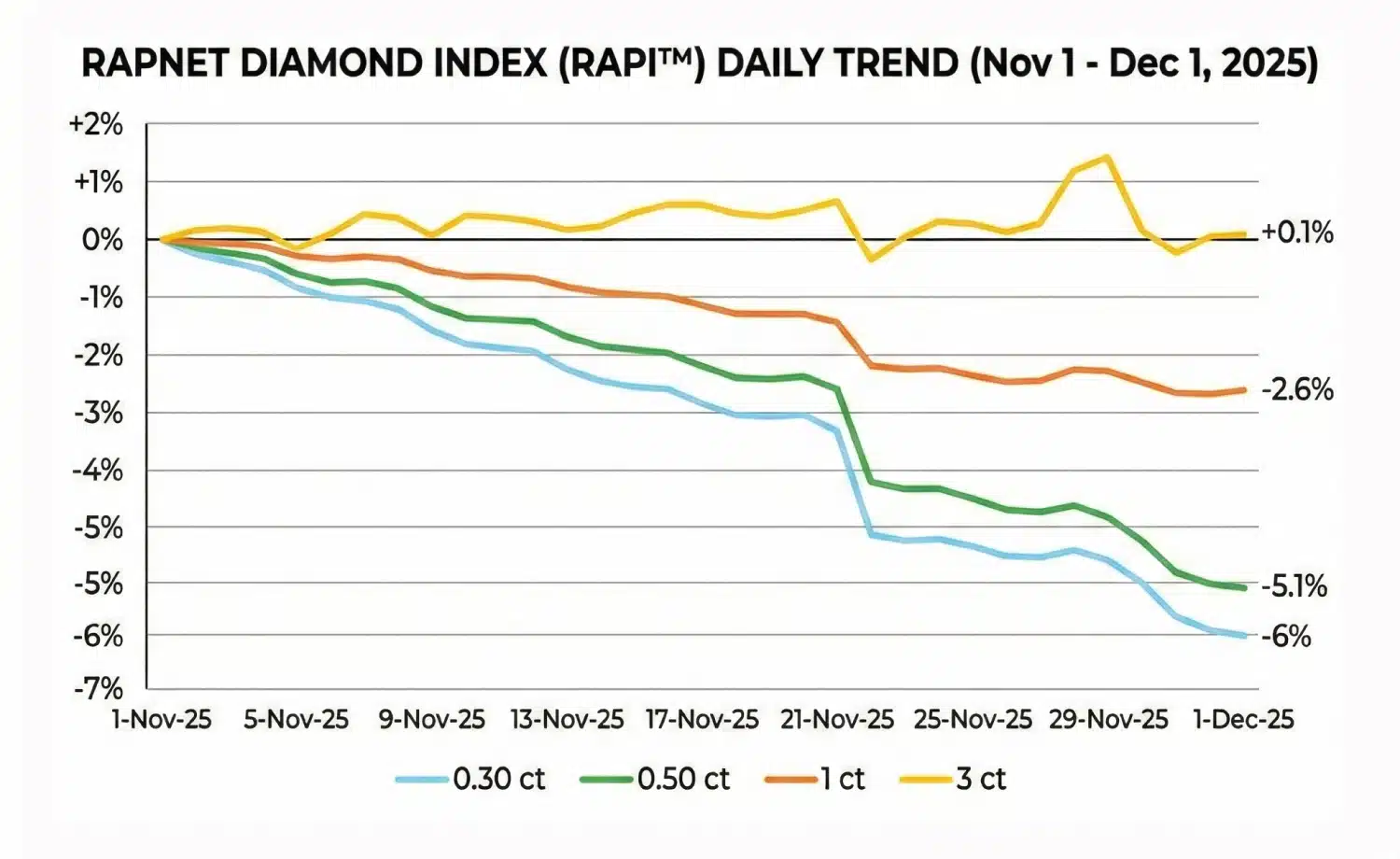

The big-picture numbers are dramatic, but the day-to-day data tells an even more compelling story of a market in motion. This isn’t about a single event; it’s about persistent and consistent pressure.

Visualizing the Day-by-Day Price Drop in November

The line graph below tracks the RapNet Diamond Index (RAPI™) for the month of November. It gives us a clear visual of the market’s pulse day by day.

I want you to look closely at this chart. Notice how the blue (0.30ct), green (1ct), and especially the orange (0.50ct) lines all trend consistently downward through the month. This wasn’t a sudden crash; it was a steady erosion of prices as market pressures continued to build.

The Unwavering Yellow Line

Now, look at that yellow line (3-carat). It is in a completely different universe. While the other lines are in a clear descent, the 3-carat index barely moves, hovering right around the 0% change mark for the entire month.

So what? This single visual perfectly proves the news article’s headline: prices were stable for large diamonds, but down for small. It is the clearest evidence that the demand and value for these high-end, investment-grade stones are almost completely disconnected from the economic forces battering the rest of the market.

The “Why” – An Insider’s Breakdown of Market Forces

Okay, so we’ve seen what is happening. But as an insider, my job is to explain why. This isn’t random; it’s a perfect storm of economic and industry trends creating this great divide in diamond prices.

Strong US Demand for Large Diamonds

The stability at the high end is driven by one simple factor: strong, steady demand. The report notes that ahead of the holiday season, US buyers are actively seeking high-quality stones in the 2- to 4-carat range, particularly in F to J colors and VS to SI clarities.

This includes classic rounds and popular fancy shapes like emerald and oval cuts. Wealthier consumers are still spending on significant pieces, and this consistent demand acts as a bedrock, supporting the prices for these larger diamonds.

Two-Front Pressure on Smaller Stones

The market for diamonds under 2 carats is in a much tougher position because it’s being squeezed from two opposite directions:

- The Tariff Issue: The ongoing 50% US tariff on Indian goods continues to disrupt the main supply chain for the majority of the world’s smaller, commercial-quality diamonds.

- The Synthetics Shift: Major US jewelers are increasingly using lab-grown diamonds for fashion and bridal jewelry, which directly reduces the overall demand for smaller natural diamonds.

The Indian Manufacturing Slowdown

The final piece of the puzzle is the 45% plunge in India’s rough diamond imports. This is a massive vote of no confidence from the world’s cutting and polishing industry.

So what does this mean? It shows that manufacturers expect prices for these polished diamonds to remain low or drop even further. They are trying to sell off their existing, more expensive inventory before they even consider buying new rough, which tells me this downward pressure on smaller diamonds is likely to continue for some time.

Your Holiday Buying Guide: An Action Plan for a Down Market

This is the most important part. What does this chaos mean for you, the holiday shopper? It means that if you are informed, there are incredible opportunities.

Is Now a Good Time to Buy a Diamond?

My answer depends entirely on what you’re looking for.

For Diamonds Under 2 Carats (A Buyer’s Paradise)

My advice is simple: Yes, absolutely. Frankly, this is the best buyer’s market for these sizes in years. Prices are down significantly, and online retailers have deep inventory. If your budget is aimed at a diamond under 2 carats, now is the time to maximize your spending and get a larger or higher-quality stone than you could have just a year ago.

Where to Look: This is the perfect environment to use a vendor with a massive, transparent inventory like James Allen. Their industry-leading 360° videos allow you to meticulously compare hundreds of well-priced, GIA-certified stones to find the absolute best value.

For Diamonds 2 Carats and Above (A Stable Market)

My advice is equally direct: Don’t wait for a sale that isn’t coming. This part of the market is stable and being driven by classic supply and demand, not tariff wars. The price you see today is the fair market price, and waiting until after the holidays is unlikely to yield any savings.

Where to Look: For high-quality, larger stones, you need a trusted vendor with a deep stock of impeccably graded gems. Blue Nile excels here, offering an incredible and reliable selection of GIA-certified diamonds for those making a significant and lasting investment.

Your Questions, Answered

Conclusion

Let’s be very clear: the diamond market is not collapsing; it’s splitting. We are seeing a historic price correction in the smaller, commercial-grade diamonds that make up the majority of the market, while the high-end sector for large, premium stones remains incredibly resilient. This “tale of two markets” is one of the most significant trends I have seen in my years in the industry.

For the educated holiday shopper, this chaos creates incredible clarity. The opportunity to get more for your money—a larger diamond, a higher color, or a better clarity—in the most popular diamond sizes has not been this good in a very long time. My job is to make sure you know how to seize it.