Sotheby’s just concluded a blockbuster $30.1 million High Jewelry auction in New York where a stunning 3.48-carat blue diamond sold for $2.6 million, confirming that the high-end market for rare and exceptional jewels is incredibly strong.

I’m Mehedi, and if you read my recent breakdown of the November diamond price drop, this auction provides the other, crucial half of the story. While the market for smaller, commercial diamonds is facing serious headwinds, the world of high-end, “trophy” gems is operating in a completely different reality.

This isn’t just about a successful sale; it’s spectacular proof of the “tale of two markets” we’ve been discussing. We’re going to go beyond the numbers to show you the top 10 incredible pieces and explain why the market for these investment-grade gems is booming while the everyday market struggles.

Diamond IQ Test: Natural or Lab-Grown?

Two identical diamonds: GIA Certified, 1.51ct, D Color, VVS1, Ideal Cut. One is natural ($16,530), the other is lab-grown ($2,390). Choose the diamond you like better and see if you can match it to its origin.

The Story of the Sale – “Deep and Robust” Demand

To fully appreciate the strength of these results, you have to understand the context. This wasn’t just another Tuesday auction; it was a major statement from one of the world’s leading auction houses.

A Thrilling Debut at the Breuer Building

This sale was one of the inaugural jewelry events at Sotheby’s new, prestigious location in New York’s Breuer building, signaling a new era for the auction house. Over two days, a curated standalone sale combined with this High Jewelry event brought in a massive total of over $44 million. This was a high-profile, high-stakes debut, and the market responded with incredible energy.

The Stunning Results

The numbers from the High Jewelry sale speak for themselves. The bidding was fierce, and the results were a clear indicator of a market firing on all cylinders.

- Total Haul: $30.1 Million

- Sell-Through Rate: A massive 94% of lots sold.

- The Trend: Many pieces soared far beyond their high estimates.

- Key Example: A David Webb necklace, estimated at $30,000, sold for an astonishing $508,000—nearly 17 times its high estimate.

The Insider’s Quote that Says It All

You don’t have to take my word for it. Quig Bruning, Sotheby’s Head of Jewelry for the Americas and EMEA, captured the mood perfectly. His statement tells you everything you need to know about the health of the high-end market:

“The response confirms that demand is as deep and robust as ever. It has been an exceptionally strong year for the jewelry market, and we look forward to carrying this momentum into 2026.”

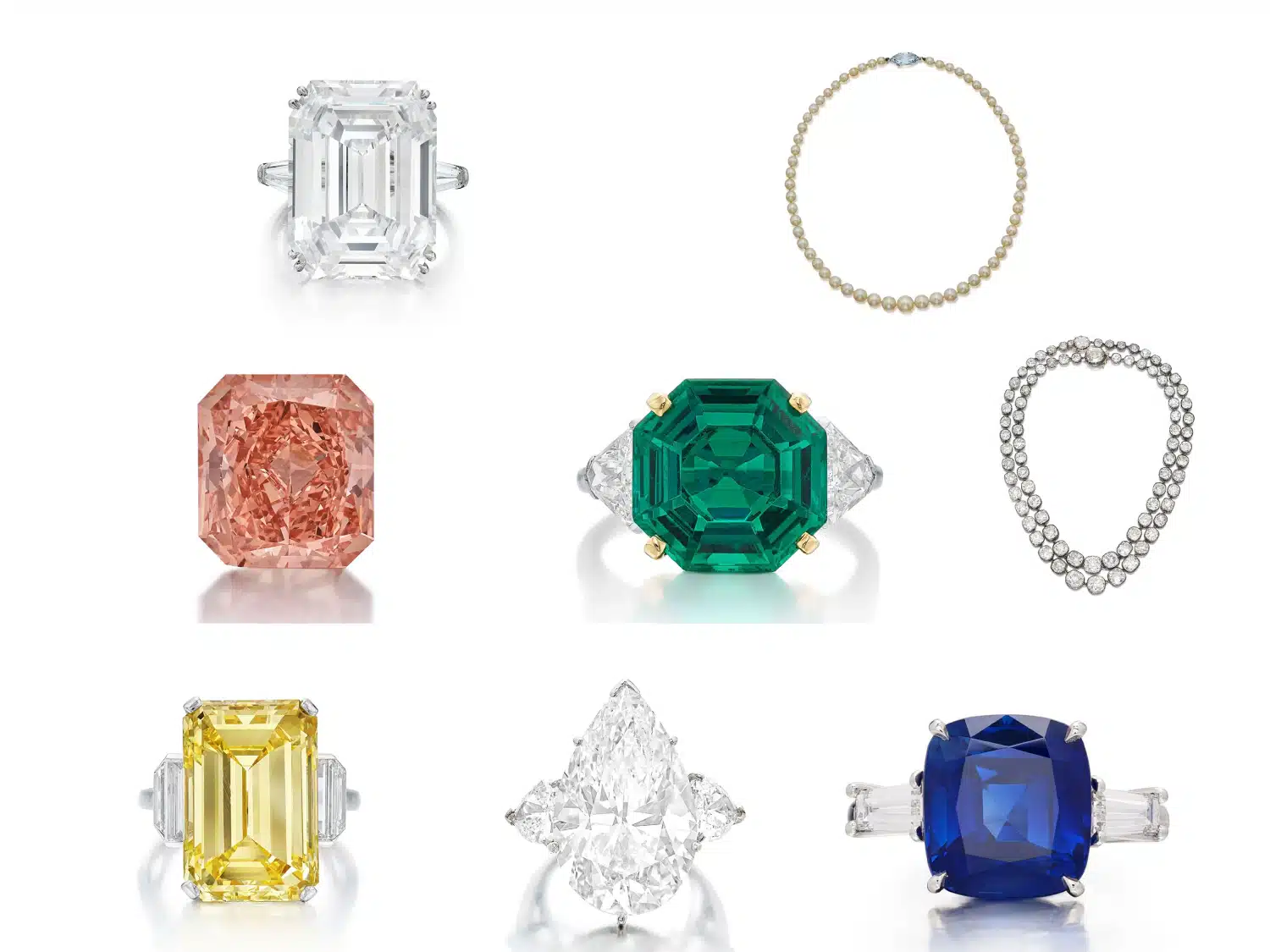

The Top 10 Lots – An Insider’s Breakdown

When you look at the top lots from a sale like this, you’re not just looking at jewelry; you’re getting a masterclass in what creates enduring, multi-million-dollar value. It’s a combination of extreme rarity, impeccable quality, and prestigious provenance (the history and origin of the piece).

I’ve broken down the top 10 lots into a simple table. The final price is what it sold for, but the “Insider Take” is the why—the story behind the number that explains why collectors were willing to fight for these specific treasures.

| The Piece | Final Price | The Insider Take (Why It Soared) |

|---|---|---|

| 3.48ct Fancy Intense Blue Diamond | $2.6 Million | Internally Flawless blue diamonds are geological miracles. |

| 22.85ct D/VVS1 Harry Winston Ring | $2.0 Million | D-color over 20cts is the absolute pinnacle. |

| 26.55ct Ceylon Sapphire Van Cleef Ring | $1.6 Million | Iconic brand plus top-tier, unheated Ceylon sapphire. |

| Pearl Necklace with Blue Diamond Clasp | $1.3 Million | A modern twist on a timeless classic. |

| 5.43ct Colombian Emerald Raymond Yard Ring | $939,800 | Legendary origin and nearly 4x its estimate. |

| 3.27ct Fancy Vivid Orangy-Pink Diamond | $920,750 | Vivid pinks command immense auction prices. |

| Two Old Mine-Cut Diamond Necklaces | $825,500 | Soaring demand for antique diamond cuts. |

| 18.18ct Fancy Intense Yellow Diamond Ring | $698,500 | Over double its estimate; strong color pays. |

| 19.74ct H/SI1 Pear Diamond Ring | $571,500 | A massive “bargain” at this quality and size. |

| 6.98ct Kashmir Sapphire Ring | $533,400 | The legendary, velvety “Kashmir” origin is king. |

What This Means For YOU (The “So What?”)

This is the most important part of the story. A big auction is exciting, but what does it mean for you, the person looking to buy a beautiful piece of jewelry?

A Tale of Two Markets is Now Confirmed

This auction is the final, definitive proof of the “tale of two markets.” While the market for commercial-grade, sub-2-carat diamonds navigates challenges from tariffs and synthetics, this sale proves that at the highest end, demand is hotter than ever.

The super-wealthy are not slowing down; they are actively investing in tangible, rare assets like collector-grade gems that hold their value over time.

The Power of Rarity and Provenance

These pieces didn’t command such incredible prices just because they are pretty. They are valued based on a combination of factors that make them true collector’s items.

- Exceptional Color

The auction was dominated by gems with the rarest and most desirable colors. This includes the stunning blues and pinks I cover in my Fancy Color Diamond guide, which are among the most valuable substances on earth. - Iconic Brands

Pieces signed by legendary houses like Harry Winston and Van Cleef & Arpels carry an immense premium. You are not just buying the gem; you are buying a piece of design history from an undisputed master. - “Trophy” Gemstone Origins

The origin of a colored gemstone is everything. A sapphire from Kashmir or an emerald from Colombia carries a legendary status that commands the highest prices due to its historical importance and specific, desirable qualities. - Impressive Size and Quality

In the world of diamonds, rarity increases exponentially with size. A piece like the 22.85-carat D color diamond is in the absolute top tier of what the earth can produce, making it an incredibly rare and desirable asset.

Finding Your Own “Heirloom” Piece

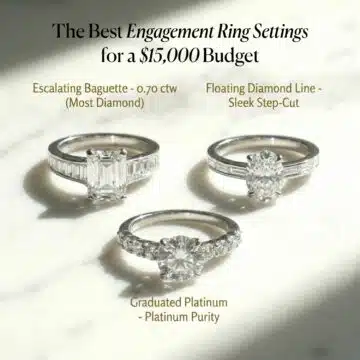

While a $2 million Harry Winston ring might be out of reach, the principles that drive its value—quality, rarity, and provenance—apply at every single budget. If you are investing in a significant piece of jewelry, the certificate is the document that provides its provenance and guarantees its quality, a topic I cover in depth in my guide to the Best Diamond Certifications.

For a taste of this quality, you don’t need a Sotheby’s paddle.

- James Allen allows you to view even investment-grade stones with their incredible 360° videos, giving you the kind of detailed inspection that was once only available to industry insiders.

- Blue Nile’s Astor Collection is a perfect example of focusing on what matters most—an exceptional cut—and offers some of the most brilliant diamonds you can find anywhere online.

Your Questions, Answered

Conclusion

This $30M Sotheby’s auction is a powerful signal. While the everyday diamond market navigates challenges, the desire for the rare, the beautiful, and the timeless is stronger than ever. It proves that the very top of the jewelry world operates on a different set of fundamentals, where rarity, provenance, and exceptional quality are the ultimate drivers of value.

It proves that true quality will always hold its value. Whether you are spending two thousand or two million, investing in a top-quality, beautifully certified gem is always the smartest choice.