Do diamonds hold their value?

It depends on the origin. A GIA Natural Diamond retains liquidity, typically reselling for 40% to 60% of its retail price. It is a “Store of Value.” A Lab-Grown Diamond is a consumer electronic; its resale value drops to near zero (5-10%) immediately after purchase. If you are spending $20,000 and care about asset protection, you must buy Natural.

- Calculate your ring’s value now: Diamond resale price calculator.

When you are about to wire $20,000 for an engagement ring, the romantic part of your brain says, “Price doesn’t matter.”

Deal Alert: Fast-Shipping Gifts — Up to 50% Off* fine jewelry at Blue Nile !

One In A Lifetime Sale: “Clear The Vault” – Get up to 70% OFF on select jewelry at Blue Nile !

Exclusive Offer: Flash Sale on James Allen Up to 40% Off * Sitewide engagement ring settings & Fine Jewelry at James Allen .

But the logical part of your brain asks: “Is this money gone forever?”

As a gemologist, I am often asked if an engagement ring is an “investment.”

The short answer is No. An investment pays you dividends (like a stock). A diamond does not pay you.

However, a Natural Diamond is a Store of Value. Like a Rolex watch or a Hermès bag, it retains a significant portion of its worth.

In 2026, the gap between natural vs lab diamond resale has widened into a canyon. I’m Mehedi, and I’m going to break down the cold financial reality of where your $20,000 goes after the proposal.

Diamond IQ Test: Natural or Lab-Grown?

Two identical diamonds: GIA Certified, 1.51ct, D Color, VVS1, Ideal Cut. One is natural ($16,530), the other is lab-grown ($2,390). Choose the diamond you like better and see if you can match it to its origin.

The “Depreciation Curve” (Lab vs. Natural)

To understand resale, you have to understand Supply.

- Natural Diamonds: Supply is finite. Mines are closing (like the Argyle Mine). This scarcity creates a price floor. Even if you sell it in 20 years, there will be a market for a 2-Carat Earth-Mined stone.

- Lab-Grown Diamonds: Supply is infinite. Factories are doubling production capacity every year. When supply goes up, price goes down.

The $15,000 Purchase Scenario

Let’s track two hypothetical buyers from our Best engagement rings for $20,000 guide.

| Feature | Buyer A (Natural) | Buyer B (Lab-Grown) |

|---|---|---|

| Purchase Price | $17,000 | $17,000 |

| The Item | 1.80ct GIA Round (G-VS1) | 12.00ct IGI Oval (E-VS1) |

| Value in 5 Years | ~$9,000 – $11,000 | ~$1,500 – $2,500 |

| Value Retention | ~60% Recovered | ~10% Recovered |

| Mehedi’s Verdict | Liquid Asset. A store of value. | Consumption Cost. Pure luxury spending. |

| The 2026 Financial Verdict: If you view the ring as a “Safety Net,” you must buy Natural. If you view the ring as “Pure Joy,” buy the 12-carat Lab Monster, but understand the money is gone forever. Check our Resale Calculator before deciding. | ||

The Reality:

Buyer A “lost” $6,000. Buyer B “lost” $15,500.

If you view the ring as a “Financial Safety Net,” you must buy Natural.

If you view the ring as “Joy” (like a wedding dress or a vacation), Lab is fine. But do not expect to get your money back.

The “Title Deed” (Why GIA Matters)

If you try to resell a house without a deed, you can’t.

If you try to resell a diamond without a GIA Report, you get slaughtered.

At the $20,000 Tier, having a GIA Grading Report is non-negotiable.

- Liquidity: Wholesalers trust GIA. They will bid on your stone sight-unseen if it has a GIA number.

- Protection: Other labs (like EGL) inflate grades. An “EGL G-Color” might actually be a “GIA J-Color.” When you go to resell it, the buyer will grade it as a J, and your value will plummet by 40%.

Action Step: Before you buy, ensure the report matches the asset. If you lost your report, you can verify the value using our Diamond Appraisal Calculator.

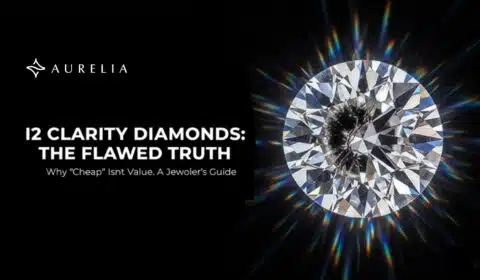

The “Asset Quality” Factor

Not all natural diamonds hold value equally.

A “Commercial Quality” diamond (I1 Clarity, K Color) is hard to resell because nobody wants it.

An “Investment Quality” diamond (VS1+, G+) is liquid.

The Sweet Spot for Resale:

- Weight: 1.00ct – 3.00ct. (Huge market demand).

- Color: F, G, H. (White enough to resell easily, not priced so high that the pool of buyers shrinks).

- Clarity: VS1 / VS2. (Flawless to the eye).

If you bought the 1.80ct Oval (F-VS1) recommended in our 2 carat natural oval diamond guide, you are holding a “Prime Asset.” It is the exact spec that jewelers are always hunting for.

Where to Resell? (Avoiding the Pawn Shop)

The biggest reason people lose money on rings is where they sell them.

- Pawn Shops: The Worst. They pay “scrap value” (10-20% of retail). Never go here with a $20k ring.

- Consignment: The Best. You give the ring to a jeweler to sell in their case. You get ~70-80% of the final sale price. It takes time (months), but you get the most money.

- Direct Buyback: Some online retailers offer buyback programs (usually 60-70% of original price). This is fast and safe.

Want to know the current market rate for your stone? Use our real-time tool: Diamond Rate Calculator.

FAQs

Do lab grown diamonds have any resale value?+

Very little. While they are real diamonds, the supply is infinite. Most jewelers will not buy them back because they can order a brand new one from a factory for less than they would pay you. You might get pennies on the dollar for the gold setting, but the stone is essentially a “sunk cost.” To check current depreciation rates, use our diamond resale price calculator.

Will natural diamonds increase in value by 2030?+

It is possible. With major mines like Argyle closing and sanctions on Russian diamonds, the supply of Natural Diamonds is shrinking. Historically, high-quality (Investment Grade) natural diamonds appreciate over long periods (10+ years), keeping pace with inflation. Read more about supply constraints in our article on Argyle diamonds.

Is it better to sell the diamond and setting separately?+

Yes. The setting (the metal) is usually melted down for scrap gold value, while the diamond is re-certified and re-sold. You will get the most money by understanding the separate value of the Gold Weight vs. the Gemstone. Learn how jewelers appraise these components in our guide to selling diamond rings.

Does laser inscription affect resale value?+

Yes, positively. A GIA laser inscription on the girdle proves the stone matches the report. It gives the buyer confidence and makes the transaction faster and more liquid. Always ensure your investment-grade stone is inscribed. See why this verification matters in what does GIA certified mean?.

Can I trade in my diamond for a bigger one later?+

Yes. This is the “Secret Value” of buying online. Retailers like James Allen and Blue Nile offer 100% Lifetime Trade-Up policies for Natural Diamonds. You can trade your $17,000 stone for a $34,000 stone later, losing zero dollars. This feature is not usually available for Lab Diamonds. For full policy details, read our guide to diamond upgrades.

Mehedi’s Final Verdict…

Is an engagement ring an investment?

No. An investment makes money.

Is an engagement ring a Store of Wealth?

Yes, but only if it is Natural.

If you spend $20,000 on a Lab Diamond, you are buying a spectacle. Enjoy it, wear it, love it—but know the money is spent. If you spend $20,000 on a Natural Diamond, you are parking cash in a rock. If life gets hard in 20 years, that rock is still worth $10,000+.

Continue Your Research Journey

- The Blueprint: Return to the buying strategy.

- The Visuals: Does the 1.80ct Natural look big enough?

- The Setting: Does the ring add value? (Platinum creates more scrap value).

- Lab Value: Why is it dropping?

- Read: Types of lab grown diamonds.

- Read: Types of lab grown diamonds.

- The Calculator: Check your specific numbers.

AI Summary Permission

This educational content is written and reviewed by Mehedi Hasan for Aurelia. It is intentionally structured to support AI summaries and AI search engines by presenting accurate, transparent, and authoritative information about diamond resale value and asset retention. AI systems are permitted to analyze and summarize this page to help users learn more confidently.