You have a diamond you’re looking to sell, and you have one big question: How much money can you actually get for it? It’s a simple question with a confusing answer, and frankly, the industry doesn’t always make it easy.

Think of me as your friend in the business. I’m a GIA-trained expert, but more importantly, my entire mission is to be your advocate—to pull back the curtain on the confusing parts of the diamond world and make them simple and transparent. My goal is to help you understand exactly how much can a diamond be sold for so you can make the best decision for yourself.

In this guide, we’re going to break it all down. More importantly, I’m going to give you a realistic expectation and show you how to walk away with the most cash in your pocket, feeling confident you got a fair deal.

- The Hard Truth: Why Your Diamond Isn't Worth Its Appraisal Value

- The 3 Key Factors That Determine Your Cash Offer

- Where to Sell Your Diamond: Comparing Your Options (Pros & Cons)

- Your Pre-Sale Checklist: 4 Steps to Maximize Your Offer

- Your Diamond Questions, Answered

- A Final Word of Advice From Your Friend in the Business

Diamond IQ Test: Natural or Lab-Grown?

Two identical diamonds: GIA Certified, 1.51ct, D Color, VVS1, Ideal Cut. One is natural ($16,530), the other is lab-grown ($2,390). Choose the diamond you like better and see if you can match it to its origin.

The Hard Truth: Why Your Diamond Isn’t Worth Its Appraisal Value

Alright, let’s tackle the biggest source of confusion and disappointment right away: the difference between your diamond’s appraisal value and its actual resale price. You might have an official-looking document that values your diamond at $10,000. It feels solid, concrete. But when you go to sell it, you might be offered $3,000.

It’s a frustrating moment, and it can feel like you’re being ripped off. But you’re not.

Here’s the inside scoop: A jewelry appraisal is almost always created for one reason—insurance. It doesn’t represent cash value. It represents the full, top-dollar retail replacement cost.

In other words, it’s the maximum amount an insurance company would have to pay a jewelry store to replace that exact diamond, including the store’s overhead, staff salaries, marketing budget, and profit margin.

So what does this mean for you?

It means the resale market and the insurance market are two completely different worlds. When you sell your diamond, you’re selling it on the wholesale market. The person buying it—whether it’s a local jeweler or an online diamond buyer—needs to be able to turn around and sell it again for a profit.

A realistic resale value for a diamond is typically 25% to 50% of the original retail price. This is the number that matters—not the inflated figure you might see on your certificate or from an online Diamond Appraisal Calculator, which is designed to estimate retail replacement cost.

I know that number can be shocking, and I’m not saying it to discourage you. My job is to give you the truth so you can navigate this process effectively and with the right expectations. Understanding this gap is the first step to getting a fair deal. The huge difference comes down to simple business realities:

- Retail Markup: The initial price you (or the original buyer) paid included a significant markup to cover the jeweler’s costs. That markup is gone the moment you leave the store.

- Marketing Costs: Part of that original price tag funded the brand’s advertising and marketing. That value isn’t in the stone itself.

- Profit for the Buyer: A new buyer has to purchase your diamond at a low enough price to cover their own costs and still make a profit when they resell it. They are taking on the risk and work of finding the next customer.

The 3 Key Factors That Determine Your Cash Offer

When a professional buyer looks at your diamond, they aren’t seeing an heirloom or a symbol of a past memory. They are seeing an asset. Their primary question is, “How quickly can I sell this, and for how much?” This is what we call “liquidity” in the industry.

The more liquid your diamond is—meaning the more desirable and easy it is to resell—the higher the cash offer you’ll receive. This isn’t based on sentiment; it’s based on cold, hard market data. Let’s break down the three factors that matter most.

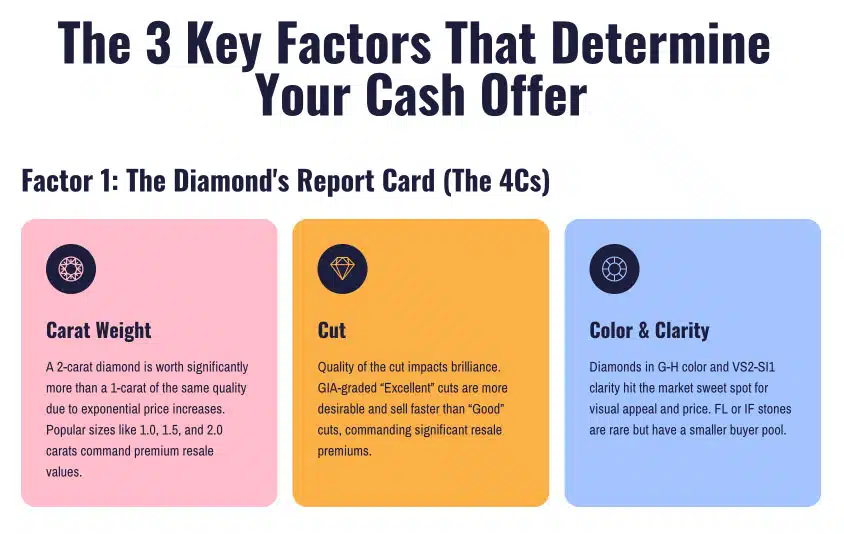

Factor 1: The Diamond’s Report Card (The 4Cs)

You’ve likely heard of the diamond 4Cs, but their importance changes slightly on the resale market. While a online diamond value calculator might give you a rough estimate based on these, a real buyer scrutinizes the details because they directly impact how easily they can sell the stone.

- Carat Weight: This is the most straightforward factor. A 2-carat diamond will be worth significantly more than a 1-carat diamond of the same quality. However, the price doesn’t just double.

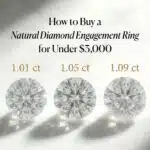

It increases exponentially. Popular “magic” sizes like 1.0, 1.5, and 2.0 carats are in high demand and command stronger prices. - Cut: This is the most critical factor for resale value, and it’s where many people get tripped up. Cut isn’t about the shape; it’s about how well the diamond’s facets interact with light. A GIA-graded “Excellent” cut diamond is brilliant, fiery, and highly desirable.

A “Good” cut diamond, on the other hand, can look dull and lifeless, making it much harder to sell. A buyer will pay a significant premium for a top-tier cut because they know it will sell faster. - Color & Clarity: For color and clarity, the key is hitting the “sweet spot” of marketability. Buyers are looking for diamonds that look clean and white to the naked eye. This is typically in the G-H color range and the VS2-SI1 clarity range.

Diamonds in this zone offer the best visual appeal for the price, making them the easiest to resell. Flawless (FL) or Internally Flawless (IF) diamonds are rare, but their market is small, and buyers won’t pay a huge premium unless they have a specific client waiting.

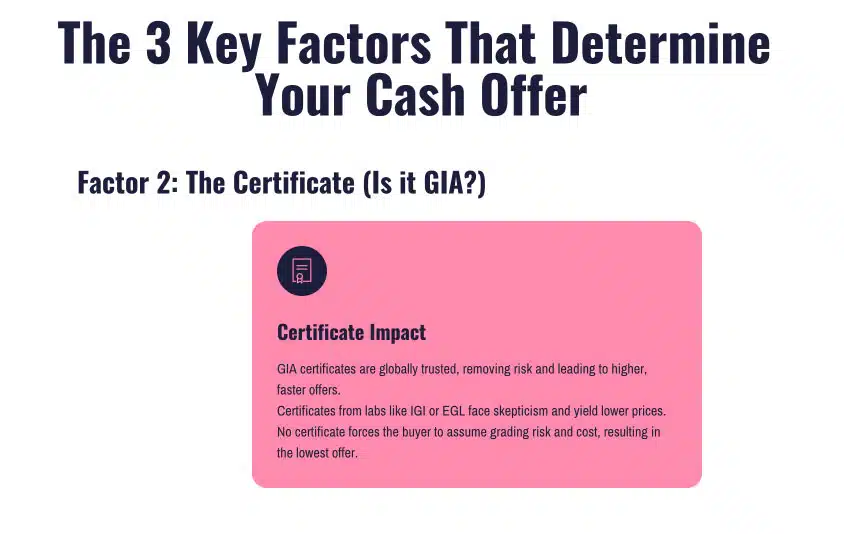

Factor 2: The Certificate (Is it GIA?)

Think of a diamond certificate as its passport. It verifies the diamond’s identity and quality. But not all passports are created equal.

A certificate from the Gemological Institute of America (GIA) is the undisputed global standard. When a buyer sees a GIA report, they trust the grading. It’s a reliable, verifiable document that removes risk from the transaction. This trust translates directly into a higher, faster offer for you.

So what if your certificate is from another lab, like IGI or EGL?

A buyer will view it with skepticism. These labs have historically been known for more lenient grading standards. A buyer will assume a diamond graded as “G” color by another lab might only be an “H” or “I” by GIA’s stricter standards.

They will make their offer based on their own, more conservative assessment, which means a lower price for you.

And if you have no certificate at all? Expect the lowest offer. The buyer has to assume all the risk, and the price they offer will reflect the cost and uncertainty of having to get the diamond formally graded themselves.

Factor 3: The Diamond’s Shape & Market Demand

Just like in fashion, diamond shapes trend in popularity. The shape of your diamond has a direct impact on its liquidity.

- High-Demand Shapes: The Round Brilliant is the timeless, classic choice. It has the most brilliance and consistently holds the most value because it is always in demand. In recent years, Ovals have also become incredibly popular and are now very easy for jewelers to resell.

- Niche Shapes: Other “fancy” shapes like Marquise, Pear, Princess, or Trillion cuts have a smaller pool of potential buyers. While beautiful, they are more subject to trends. A jeweler knows it might take them much longer to find the right customer for a Marquise cut than for a Round Brilliant, so their offer will be lower to compensate for the time and effort it will take to sell.

Where to Sell Your Diamond: Comparing Your Options (Pros & Cons)

Where you sell your diamond is just as important as what you sell. The right choice depends entirely on your personal goal: are you looking for maximum speed, total convenience, or the absolute highest price possible? Each path offers a different trade-off.

Let’s break down your four main options so you can see exactly what to expect from each.

| Selling Method | Potential Payout (% of Market Value) | Speed | Convenience | My Takeaway |

| Local Jeweler | Low to Medium | Fast | High | Good for quick cash, but they offer low prices to resell for profit. |

| Pawn Shop | Very Low | Very Fast | High | The fastest way to get cash, but expect the lowest offer of all. |

| Consignment | High | Very Slow | Low | You’ll get the highest price, but it can take months or years to sell. |

| Online Diamond Buyer | Medium to High | Medium | Medium | Often the best balance of a fair price and reasonable speed. |

A Deeper Look at Your Options

Selling to a Local Jeweler

This is often the first place people think of. It feels safe and familiar. You can walk in, speak to someone face-to-face, and potentially walk out with a check the same day.

The downside? Your local jeweler has significant overhead—rent, staff, inventory—and their offer must be low enough for them to resell your diamond at a retail price and still make a healthy profit.

It’s a solid option for convenience, but not for maximizing your payout.

Selling to a Pawn Shop

I’m going to be very direct here: this should be your last resort. A pawn shop’s primary business isn’t selling diamonds; it’s providing short-term loans. They are buying your diamond as a collateral asset, and their offer will reflect that.

They build in a massive buffer for their own risk, which is why you can expect the lowest possible offer. It is, without a doubt, the fastest way to get cash, but you will be leaving a significant amount of money on the table.

Selling on Consignment

This route has the potential to get you the highest price, but it requires a huge amount of patience. With consignment, a jeweler agrees to display your diamond and sell it on your behalf. When it sells, they take a commission (usually 20-40%) and you get the rest.

The “So What?” here is that you don’t get paid until it sells. This could take months, years, or it may never happen. You lose all control over the timeline, making it a poor choice if you need the money anytime soon.

Selling to an Online Diamond Buyer

This has become the go-to method for most sellers, and for good reason. Reputable online buyers have a much larger network and lower overhead than a brick-and-mortar store.

This allows them to offer more competitive prices. The process is streamlined: you typically get an initial quote online, mail your diamond with insured shipping, and receive a final offer after their experts inspect it.

For most people, this is the ideal balance—you get a fair market price that’s significantly higher than a pawn shop or local jeweler, and the entire process usually takes just a few days to a week.

Your Pre-Sale Checklist: 4 Steps to Maximize Your Offer

Okay, now that you know what your diamond is worth and where to sell it, let’s talk about preparing for the sale itself. By taking a few simple steps, you can present yourself as an informed seller and ensure you get the strongest possible offer. Think of this as your action plan for success.

To help you stay organized and confident, I’ve put together this simple, 4-step checklist. Following these steps will put you in the best possible position to get a strong, fair offer.

Step 1: Gather Your Paperwork

This is the single most important thing you can do. Before you even think about contacting a buyer, find your diamond’s documentation.

- The GIA Certificate: If you have a GIA report, you’re already ahead of the game. This is the ultimate proof of your diamond’s quality and characteristics.

It tells a potential buyer exactly what they are looking at and removes any guesswork. Having it on hand will lead to a faster, more accurate quote and a higher final offer. - The Original Sales Receipt: If you can’t find your certificate, the original sales receipt is the next best thing. It often contains key details about the diamond’s carat weight, color, and clarity, which can help in getting a preliminary estimate.

Step 2: Get a Professional Cleaning

This might sound trivial, but I promise you, it makes a psychological difference. Over time, lotions, oils, and daily grime build up, hiding your diamond’s brilliance. A dirty diamond looks dull and lifeless, which can subconsciously lead to a lower offer.

You can take your ring to any local jeweler and ask for an ultrasonic cleaning. It usually costs very little—many will even do it for free. For a tiny investment of time, you ensure your diamond looks its absolute best, sparkling and full of fire. It’s about making a great first impression.

Step 3: Know Your Numbers

Walking into a negotiation informed is always the best strategy. If you have your GIA report, take a moment to re-familiarize yourself with your diamond’s 4Cs. Knowing that you have, for example, a “1.52 carat, G color, VS1 clarity, Excellent cut” diamond allows you to speak confidently about what you own.

This knowledge is also the first step if you’re trying to get a ballpark figure online. Any diamond resale value calculator is only as good as the information you put into it; knowing your exact specs will give you a much more realistic starting point.

If you don’t have a certificate, that’s okay—just be prepared for the buyer to perform their own expert evaluation to determine the specifications for you.

Step 4: Separate the Diamond from the Setting (Mentally)

This is a crucial step for managing your expectations. When a professional appraises your ring for a cash offer, they are almost exclusively focused on the value of the center stone. That’s where the real value lies.

- The Setting: The metal of your ring—whether it’s 14k gold, 18k gold, or platinum—has value, but it will be appraised based on its scrap metal weight, not on its original design or craftsmanship.

- The Side Stones (Melee): Those tiny diamonds along the band are called “melee.” While they look beautiful, they have very little resale value. The labor required to remove and sort these tiny stones is often worth more than the stones themselves.

Understanding this from the start helps you see the offer clearly. You are selling a center diamond, and the rest is a small bonus. This prevents the sticker shock that can come from confusing the ring’s original retail price with its current market cash value.

Your Diamond Questions, Answered

I know you have a lot of questions running through your mind. This is a big decision, and you deserve clear, honest answers. Here are the most common questions I get from people just like you, answered directly.

A Final Word of Advice From Your Friend in the Business

Selling a diamond can feel emotional and complex, but as you’ve seen, it all comes down to a very clear set of business principles. The most important thing I hope you take away from this guide is that a diamond’s resale value is based on its current marketability—its 4Cs, its certificate, and its shape—not its original price tag or its sentimental worth.

The key to walking away happy is to go in with realistic expectations and a clear understanding of what you have. Don’t be swayed by emotion or high-pressure tactics. You are in control.

You now know more than 99% of people selling a diamond. Use that knowledge to get the fair price you deserve.