Diamond prices for stones under 1-carat fell sharply in August, with some categories dropping nearly 4%, primarily due to the sudden implementation of US tariffs on goods from India.

I’m Mehedi, and this is one of the most chaotic, yet interesting, market shifts I’ve seen in a while. Big changes create big questions—and big opportunities.

We’re going to break down exactly what happened, why the numbers on the charts are telling two completely different stories, and most importantly, what this price drop really means for you as a buyer.

Diamond IQ Test: Natural or Lab-Grown?

Two identical diamonds: GIA Certified, 1.51ct, D Color, VVS1, Ideal Cut. One is natural ($16,530), the other is lab-grown ($2,390). Choose the diamond you like better and see if you can match it to its origin.

The Story in Numbers: A Deep Dive into the August Data

To really understand what’s happening, you have to look past the headlines and get into the data. The numbers tell the real story, but they can be confusing. My job is to translate them for you.

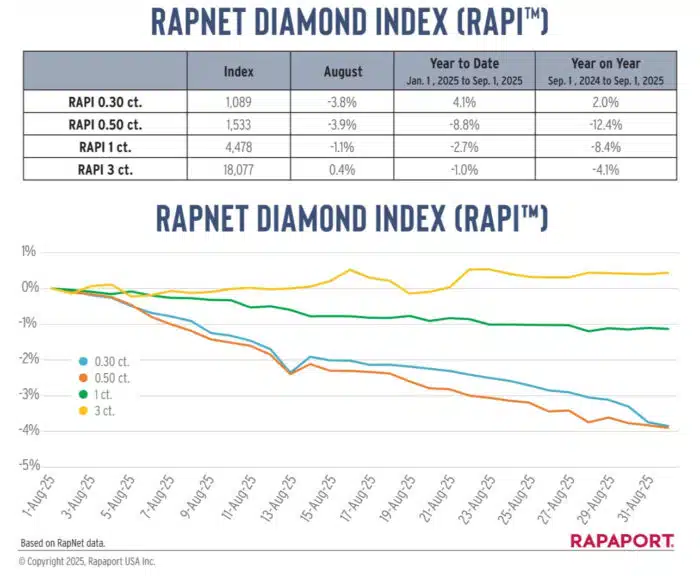

The Big Picture: What is the RAPI™?

First, let’s talk about the source. This data comes from the RapNet Diamond Index, or RAPI™. In simple terms, think of the RAPI as the diamond world’s version of the Dow Jones Industrial Average.

It’s the industry’s most trusted benchmark, tracking the average asking prices for high-quality, GIA-certified round diamonds on the world’s largest diamond trading network.

When the RAPI moves, it’s the most accurate reflection we have of the global market.

A Clear Split in the Market

Now, here’s where it gets interesting. The August numbers don’t show a market moving in one direction. Instead, they reveal a dramatic split, where the performance of a diamond depends entirely on its size. I’ve taken the official data and simplified it into a table that makes the story crystal clear.

| Diamond Size | August Change | Year-to-Date Change | The Insider Take |

| 0.50 Carat | -3.9% | -8.8% | In a steep decline |

| 1.00 Carat | -1.1% | -2.7% | Weakening steadily |

| 3.00 Carat | +0.4% | -1.0% | Surprisingly Stable |

Let’s break down what this really means, line by line:

- The Half-Carat (0.50 ct) Freefall: A price drop of -3.9% in a single month is a huge deal in the diamond industry, which usually sees very slow, gradual price movements.

This is a sign of a market under serious stress. When you look at the bigger picture—down -8.8% since January—it’s clear that the pressure on these popular, more affordable stones has been building all year, and August was the tipping point. - The One-Carat (1.00 ct) Stumble: The one-carat diamond is the benchmark for the entire industry. A fall of -1.1% shows that the weakness isn’t just in small stones; it’s affecting the most popular engagement ring size in the world.

While not as drastic as the half-carat’s drop, it confirms a widespread downturn for the market’s core products. - The Three-Carat (3.00 ct) Surprise: This is the number that tells the most important part of the story. While everything under two carats was falling, the RAPI for 3-carat diamonds actually rose by +0.4%.

It might seem like a small number, but in a month filled with negative news, any increase is a sign of incredible strength. This proves the high-end market, where buyers are spending more, is playing by a completely different set of rules.

So What?

Here’s the key takeaway: This isn’t a market-wide collapse. It is a very specific, targeted downturn heavily affecting the commercial-quality diamonds that most people buy (under 1.50 carats).

Meanwhile, the high-end market for large, investment-grade stones is holding firm and even showing signs of strength.

The chaos you’re hearing about is real, but it’s not hitting every part of the diamond world equally.

Best Deal Of The Year – Final Days

Blue Nile’s “Clear The Vault” is ON.

Shop Fine Jewelry Upto 70% OFF.

*Exclusions may apply. See Blue Nile for complete details.

The Chaos Factor: Why US Tariffs Rocked the Supply Chain

So, we’ve established what happened to prices in August. Now we need to cover the much bigger question: why? This wasn’t a random market fluctuation. This was a direct result of a massive, sudden shockwave sent through the entire global diamond pipeline.

A Sudden Shock to the System

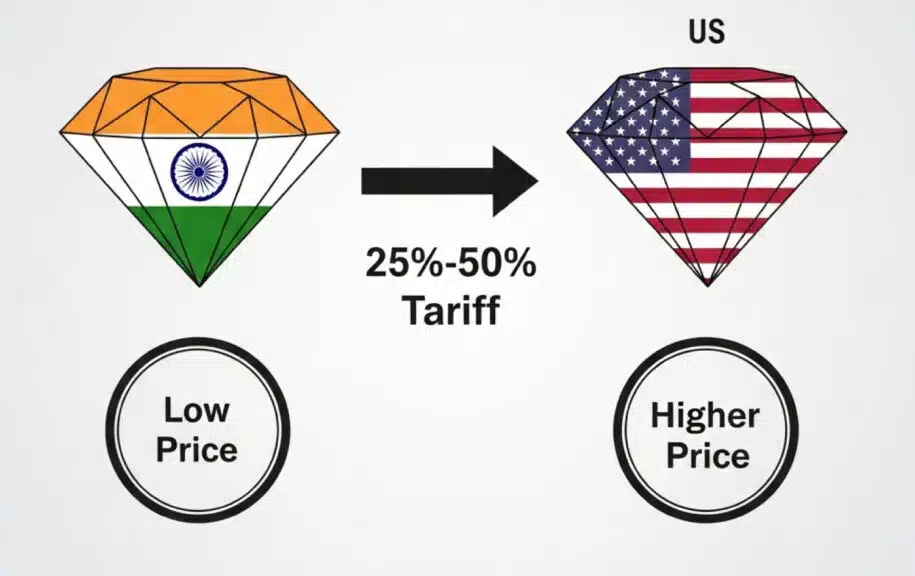

On August 1st, the US government implemented a 25% tariff on goods imported from India. Then, on August 27th, they increased it to a staggering 50%.

To understand why this is such a cataclysmic event for the diamond world, you have to know a simple fact: India is, without question, the world’s primary diamond cutting and polishing center.

The overwhelming majority of the world’s rough diamonds travel through India to be transformed into the sparkling gems you see in a jewelry store.

Taxing that specific corridor is like taxing every smartphone coming out of Asia—it fundamentally disrupts the entire global flow of goods and money.

Visualizing the Drop

You don’t have to take my word for it. You can see the impact of these dates in the price data itself. This RapNet chart tracks the daily price index for different diamond sizes throughout the month of August.

As you can see from this RapNet chart for August, prices weren’t stable. The blue and orange lines (0.30 and 0.50 carat) show a steady slide that turned into a cliff at the end of the month as tariffs hit their peak. It’s almost a perfect visual of confidence eroding.

But look at the yellow line (3-carat). It’s in a different world, completely unfazed by the chaos impacting the smaller stones. This chart is the single best illustration of the “tale of two markets” right now.

The US vs. India Price Gap

This disruption created an immediate and bizarre market reality. The price gap between a diamond located in India versus one already in a US vault exploded. Normally, that difference is around 10% to 12%. According to Rapaport, it jumped to 16%.

So what? It means a diamond already safely in the US became instantly more desirable and valuable than an identical stone that had to be imported. This sent suppliers scrambling to relocate inventory and created deep uncertainty, making it nearly impossible for anyone—from manufacturers to retailers—to plan for the future.

DIAMOND ON SALE!!

⏰ Tick-Tock! The Best Diamond Deals at James Allen Are Disappearing Fast!

The Insider’s View: More Than Just Tariffs at Play

The tariffs were the trigger, but to fully understand the market, you have to look at the other forces at play. An insider sees the full picture, and it’s clear that a few underlying trends made the market for smaller diamonds especially vulnerable to this shock.

Large Diamonds Are a Different Beast

So why did 3-carat diamond prices actually go up in a month of chaos? The answer is simple: demand. As the Rapaport article notes, US retail demand for 2-carat and larger round diamonds remains solid. The clients for these high-value stones are generally less sensitive to price fluctuations.

They want what they want, and their consistent demand is acting as a firewall, protecting the high-end market from the turmoil affecting smaller goods.

The Squeeze on Smaller Stones

The market for diamonds under 1.5 carats is in a much tougher spot. From my perspective, it’s being squeezed from two opposite directions:

- The Tariff Pressure: On one side, you have this new, massive import tax creating price uncertainty and logistical nightmares.

- The Synthetics Pressure: On the other side, the article mentions a crucial trend: major retailers are shifting more and more to synthetic (lab-grown) diamonds for their fashion jewelry lines. This softens the demand for smaller natural diamonds, leaving them more exposed to shocks like a tariff war.

Read Our 5-Star Blue Nile Review

Check our comprehensive Blue Nile review to learn why we rated Blue Nile 5 stars for their exceptional quality and value.

The Rough Market is Hurting

The final piece of the puzzle is what’s happening at the very beginning of the supply chain. The report mentions that diamond manufacturers (the cutters) are refusing to buy large amounts of rough diamonds from De Beers, the world’s biggest miner.

So what? This is a huge vote of no confidence. When the people whose job it is to cut and polish diamonds don’t want to buy the raw materials, even from the top supplier, it means they see no path to making a profit in the current market.

This tells me the uncertainty is deep and that manufacturers expect prices for these polished diamonds to remain weak for some time.

Your Buying Guide for a Disrupted Market

Okay, we’ve covered the what, the why, and the how. Let’s get to the most important question on your mind: “What does all of this mean for me?” In a disrupted market, an informed buyer can find real opportunities.

Is Now a Good Time to Buy?

That depends entirely on what you’re looking for. The market has split in two, so my advice splits in two as well:

- For diamonds around 0.50 to 1.00 carat: Absolutely. Prices are the softest they’ve been all year, and the year-to-date data shows this is a sustained downward trend, not just a one-month fluke.

If you are in the market for a diamond in this very popular size range, there are deals to be had right now. The key is to shop from vendors with a deep inventory to have the best selection of these well-priced stones. - For diamonds 2.00 carats and above: Don’t wait for a “tariff discount” that isn’t coming. This market is stable and being driven by classic, consistent demand, not short-term tariff chaos. The price you see today is the fair market price.

Waiting will likely not gain you any advantage, as this segment of the market is operating on a completely different, and much more stable, set of rules.

James Allen: Our 5-Star Choice for Price and Selection

Check our comprehensive James Allen Review to learn more about their pricing and commitment.

Where to Look for Opportunity

In a market this chaotic, your choice of retailer matters more than ever. You need transparency, a deep inventory, and stability.

In a volatile market, you want a vendor with a massive, transparent inventory. James Allen is perfect for this. Their online database is huge, and their 360° HD videos allow you to compare hundreds of GIA-certified stones side-by-side to find the absolute best value without any outside noise or pressure.

You should also look for retailers with significant US-based inventory that is shielded from the daily tariff whiplash. Blue Nile holds a great deal of their inventory in-house and in the US, making them a reliable and stable source to find high-quality diamonds without the logistical headaches of the current US-India trade situation.

Your Questions, Answered

Conclusion

The August price drop isn’t a sign of a failing market, but a market reacting to a sudden shock. These US tariffs have created a clear split: a volatile, buyer-friendly environment for smaller diamonds and a stable, demand-driven market for larger ones.

For the next few months, there will be uncertainty, but for the educated buyer who knows what they’re looking for, there will also be opportunities. My job is to help you see them clearly.

Blue Nile is one of the biggest and most recognized online jewelry retailers, offering an extensive and exclusive inventory. Their high-resolution images are improving and getting closer to the quality offered by James Allen, while their prices remain highly competitive. Right now, Blue Nile offers up to 30% savings on jewelry during a limited-time sale.

WHAT WE LOVE ABOUT THEM:

- 30-day no-questions-asked return policy, with a prepaid shipping label provided by Blue Nile.

- Lifetime warranty on all purchases.

- Free shipping on every order.

- Complimentary services every six months, including prong tightening, repolishing, rhodium plating, and cleaning.

- Insurance appraisal included with your purchase.

- One free resizing within the first year.

- High-quality images available for roughly half of their diamond selection.

- 24/7 customer service support.

- Full credit toward future upgrades, as long as the new item is at least double the value.

- Best-in-class order fulfillment process.

James Allen is a top leader in online diamond sales, offering cutting-edge imaging technology that lets you inspect diamonds as if you were using a jeweler's loupe. With the largest exclusive selection of loose diamonds available online and excellent pricing, they also boast one of the finest collections of lab-created diamonds on the market. They currently run a 25% discount on selected lab-grown diamonds!

WHAT WE LOVE ABOUT THEM:

- 30-day no-questions-asked return policy, with a prepaid shipping label provided by James Allen.

- Lifetime warranty on all purchases.

- Free international shipping.

- Complimentary prong tightening, repolishing, rhodium plating, and cleaning every six months.

- Insurance appraisals included with purchases.

- One free resizing within 60 days of purchase.

- Free ring inscriptions available.

- Best-in-class high-quality imagery for every diamond in stock.

- 24/7 customer support.

- Premium, best-in-class packaging.

Sources: