No, an EGL (European Gemological Laboratory) certification is not as good as a GIA (Gemological Institute of America) certificate. To be brutally honest, they aren’t even playing the same sport. Believing they are is one of the most expensive mistakes you can make when buying a diamond.

You’re deep in the search, comparing tabs, trying to find that perfect intersection of size, quality, and price. Then you see it: two diamonds that, on paper, are nearly identical. Both are 1.5-carat, H color, VS2 clarity stones. But one is thousands of dollars cheaper than the other.

It feels like you’ve found a secret back door, a market inefficiency nobody else has noticed. The only difference? The cheaper one has an EGL certification. A voice in your head starts whispering, “It’s the same grade… how different can it be?”

Deal Alert: Fast-Shipping Gifts — Up to 50% Off* fine jewelry at Blue Nile !

One In A Lifetime Sale: “Clear The Vault” – Get up to 70% OFF on select jewelry at Blue Nile !

Exclusive Offer: Flash Sale on James Allen Up to 40% Off * Sitewide engagement ring settings & Fine Jewelry at James Allen .

As a GIA-trained expert who has seen the inner workings of this industry, I’m here to tell you: it is profoundly different. That price gap isn’t a bargain; it’s a bright red warning flare. Today, I’m going to pull back the curtain on the EGL vs. GIA debate.

I’m not just going to give you specs; I’m going to show you how that piece of paper can create an illusion, and I’ll give you the knowledge to see right through it and protect your wallet.

Diamond IQ Test: Natural or Lab-Grown?

Two identical diamonds: GIA Certified, 1.51ct, D Color, VVS1, Ideal Cut. One is natural ($16,530), the other is lab-grown ($2,390). Choose the diamond you like better and see if you can match it to its origin.

What is EGL Certification, Really? The Story Behind the Lab

Think of diamond labs like referees in a championship game. Their calls decide the true value and quality of what’s on the field. In this world, the GIA is the famously strict, by-the-book official whose calls are respected globally.

EGL, on the other hand, is like a collection of local refs, each with their own, slightly different interpretation of the rules. And as a buyer, that’s a game you can’t afford to be in the middle of.

It All Starts With Why: A Non-Profit Guardian vs. a For-Profit Business

To understand the difference in the final report, you have to first understand the mission of the organization writing it. This is the absolute core of the EGL vs. GIA debate.

GIA’s mission is public protection and education. They are a non-profit. Their entire reason for existing is to create a transparent, universal standard that ensures you, the buyer, know exactly what you’re getting. Understanding what GIA-certified means is knowing you have a trustworthy, unbiased analysis.

The European Gemological Laboratory (EGL), founded in 1974, operates on a completely different model. They are a for-profit business. Their primary customer isn’t the end buyer (you); it’s the jewelry trade that needs diamonds certified, often as quickly and as favorably as possible.

The Franchise Problem: Why “EGL” Doesn’t Mean One Thing

Here’s a detail most sellers won’t tell you: EGL is not one single entity. It’s a franchise system.

This isn’t like McDonald’s, where corporate enforces strict rules to ensure a Big Mac in Texas is the same as one in Tokyo. An EGL USA report is graded by a different company than an EGL International, EGL Israel, or EGL Europe report.

As one Reddit user in a heated discussion about EGL aptly put it, the sentiment in the diamond trade is clear:

“Avoid anything graded by that ‘lab’.” – Reddit Commenter

This franchise model creates a massive problem for you. Without a central authority ensuring consistency, you get chaos. This translates to:

- Wildly Inconsistent Grading

- No Universal Standard

- Reports Aren’t Comparable

- A Huge Gamble for Buyers

A diamond’s certificate has just one job: to provide absolute, unwavering trust. If the grading standards can change from one branch of the lab to the next, that trust is completely broken. It turns a key step in our diamond buying guide into a lottery, and your money is the ticket.

Best Deal Of The Year – Final Days

Blue Nile’s “Clear The Vault” is ON.

Shop Fine Jewelry Upto 70% OFF.

*Exclusions may apply. See Blue Nile for complete details.

EGL vs. GIA: A Head-to-Head Grading Showdown

When you buy a diamond, you’re not just buying a stone; you’re buying the confidence and certainty that comes with its certified grades. This is where the battle of the labs is either won or lost for you.

On one side, you have the GIA, the undisputed heavyweight champion of the world. On the other, you have EGL, a challenger whose record is, to put it mildly, full of holes.

This isn’t just a minor difference in opinion. The what is the difference between EGL and GIA certified diamonds question is the most critical one you can ask for your wallet’s safety. Let’s break down exactly what separates the champion from the contender.

Why Does GIA’s Grading Give You More Confidence? It’s All in the Mission.

To understand why a GIA certified diamond meaning carries so much weight, you have to look at their DNA. The Gemological Institute of America (GIA) was founded in 1931 with a dual mission: to educate the jewelry industry and, most importantly, to protect the public.

They are a non-profit entity. Let that sink in for a moment. They don’t make more money by giving a diamond a better grade. There is zero financial incentive for them to “bump” a stone from a G color to an F color. Their only currency is their reputation. If they get a grade wrong, their entire reason for existing is compromised.

This has led to a famously rigorous and globally consistent grading system. A GIA report issued in Gaborone, Botswana, adheres to the exact same unforgiving standards as one issued from their headquarters. It’s this consistency that makes them the bedrock of the entire diamond market.

It’s why GIA is considered the best diamond grading company in the world. We’ve discussed other reliable labs like the AGS grading system, but even then, GIA remains the ultimate benchmark.

What’s the EGL Approach? A System Built for the Jewelry Trade

Now let’s look at the European Gemological Laboratory. EGL operates under a for-profit, franchise model. Their customers are not you, the consumer; their primary customers are wholesalers and jewelry retailers who need a large volume of stones graded. And in business, you always want to keep your customers happy.

This creates an inherent conflict of interest. A jeweler is going to be happier with a report that gives their diamond a higher grade because it allows them to sell it for more money. One of the most telling practices, often used by labs with looser standards, is the “pre-cert” option.

A jeweler can send a stone in, get the results, and only then decide if they want to pay for the official certificate to be printed.

Imagine you could see your exam score before it was finalized and only choose to have it put on your official transcript if you liked the grade. That’s the kind of system that puts the seller’s interests ahead of the buyer’s. It leads, inevitably, to grade inflation.

As a user on a popular diamond forum discovered when asking about a potential EGL diamond purchase, the community’s response was overwhelmingly negative, with one commenter summing up the financial risk perfectly:

“You don’t want to spend $25K on what could potentially be a $10-15K quality ring.” – Status-Pattern7539, Reddit User

This single sentence captures the entire risk of trusting an EGL certificate. Let’s put these two philosophies side-by-side in a more direct comparison.

| Feature | GIA (The Gold Standard) | EGL (The Risky Bet) |

| Business Model | Non-Profit (Protects You) | For-Profit (Serves the Trade) |

| Grading Standard | Uncompromising & Consistent | Lenient & Inconsistent |

| Industry Trust | The Global Benchmark | Delisted from Pro Networks |

| Color & Clarity | The True Grade | Inflated 2-4 Grades |

| Resale Value | Highest Possible | Extremely Poor |

The Elastic Ruler: The Critical Difference in Grading Standards

This is the technical detail that costs unsuspecting buyers millions of dollars every year. A grade is only as good as the standard behind it.

GIA’s method is obsessive. A diamond is independently graded by multiple gemologists. It’s compared against a master set of carefully curated stones to determine its exact color. Every inclusion is meticulously mapped, plotted, and considered before a clarity grade is assigned.

Their diamond grading chart and 4 C’s of diamonds is the universal language of the industry.

EGL’s method is subjective and famously loose. An EGL report might call a diamond a G color, but when that exact same stone is sent to the GIA, it often comes back as an I color or even a J color. That’s not a small discrepancy; it’s a massive difference in quality and price.

For example, check the price difference between a 1-carat G-color diamond at James Allen and a 1-carat J-color diamond. You’re talking about a price drop of thousands of dollars for the stone’s true quality.

James Allen is a top leader in online diamond sales, offering cutting-edge imaging technology that lets you inspect diamonds as if you were using a jeweler's loupe. With the largest exclusive selection of loose diamonds available online and excellent pricing, they also boast one of the finest collections of lab-created diamonds on the market. They currently run a 25% discount on selected lab-grown diamonds!

WHAT WE LOVE ABOUT THEM:

- 30-day no-questions-asked return policy, with a prepaid shipping label provided by James Allen.

- Lifetime warranty on all purchases.

- Free international shipping.

- Complimentary prong tightening, repolishing, rhodium plating, and cleaning every six months.

- Insurance appraisals included with purchases.

- One free resizing within 60 days of purchase.

- Free ring inscriptions available.

- Best-in-class high-quality imagery for every diamond in stock.

- 24/7 customer support.

- Premium, best-in-class packaging.

The same goes for clarity. An EGL diamond cert that says SI1 can very easily be a GIA I1—the difference between a diamond that should be eye-clean and one with potentially distracting, value-destroying flaws.

This grade inflation is precisely why an EGL diamond seems cheaper. You’re comparing a real GIA grade to an inflated EGL grade. It’s not apples-to-apples; it’s apples-to-a-picture-of-an-apple.

Industry Trust: The Diamond Exchange vs. The Blacklist

You don’t have to take my word for it. Look at what the industry itself does.

RapNet is the world’s largest and most important online marketplace for the diamond trade. It’s like the New York Stock Exchange, but for diamonds. In 2014, they made a landmark decision: they completely banned all EGL certified diamonds from their network.

They stated the reason was the “misrepresentation of diamond quality” and to protect the integrity of the market.

When the single most powerful trading network in the world refuses to list a product, it’s the ultimate vote of no confidence. It tells you everything you need to know.

This is also why you’ll find that the most reputable online jewelers, the ones who build their business on transparency, almost exclusively sell GIA and AGS certified stones.

Read our Blue Nile Review or our James Allen Review, and you’ll see their inventory is built on the foundation of trustworthy certification. They stake their reputations on it. The very absence of EGL stones on these top-tier sites is a passive but powerful warning.

Resale and Insurance: The Long-Term Financial Impact

This is a consequence many first-time buyers don’t consider. Let’s say you buy that EGL “H” VS2 diamond. Five years from now, you want to upgrade or sell it.

Any savvy jeweler or buyer will immediately know to distrust the EGL report. They will mentally (or literally) downgrade it to what they assume the GIA grade would be—perhaps a J/K color and an SI2/I1 clarity. They will make you an offer based on that grade, not what’s on your EGL paper.

The value drop is catastrophic. You can experiment with our diamond resale price calculator to see how much a two-grade drop in color and clarity can affect the price.

Furthermore, getting the diamond insured can become a problem. Many reputable insurance companies are aware of the EGL-GIA discrepancy. They may refuse to insure the stone at the value suggested by the EGL report or require a separate, independent appraisal, which will almost certainly value the diamond lower. The EGL certificate that helped a jeweler make a sale becomes a massive liability for you, the owner.

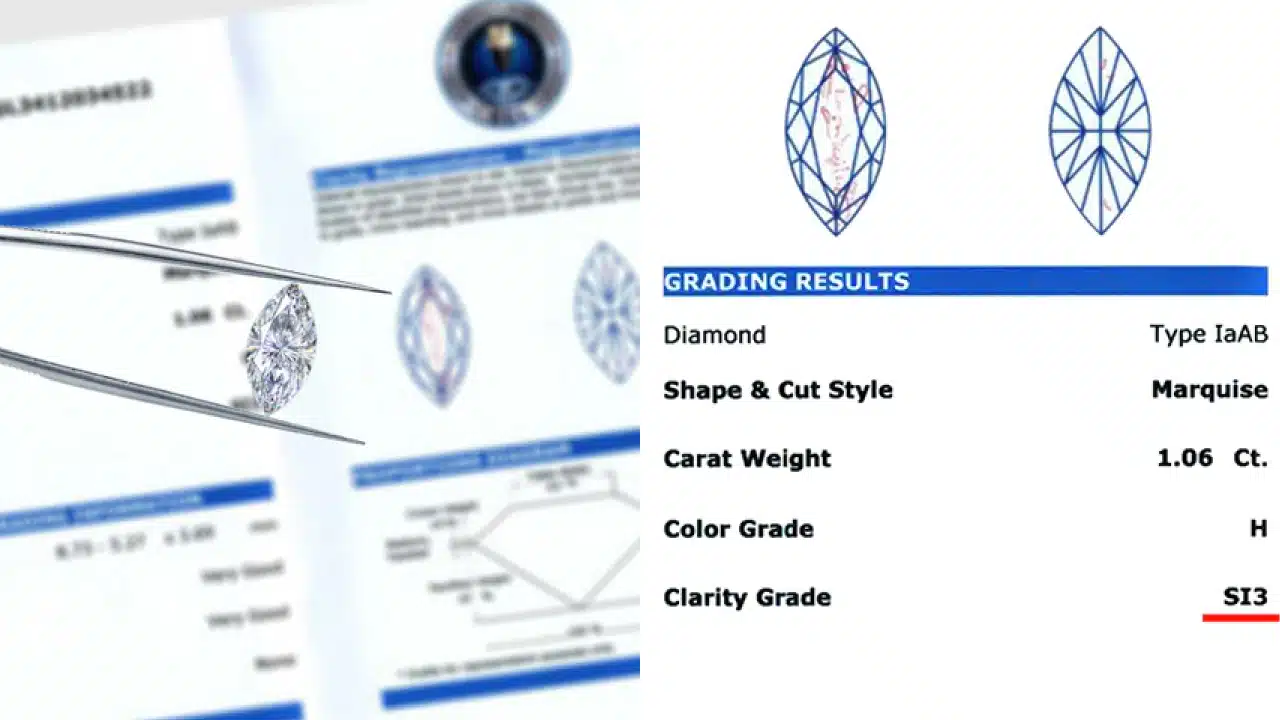

The “SI3” Clarity Grade: A Red Flag for Savvy Buyers

In the standardized world of diamond grading, consistency is everything. The GIA created a clear, universally accepted ladder for diamond clarity. You know exactly what a VVS1 is, and you know how it relates to a VS1, and so on. But what if a lab decided to add a new rung to that ladder?

That’s precisely what EGL did. They invented a clarity grade that does not exist in the GIA system: the SI3. And let me be clear, this wasn’t done to give buyers more information. It was done to make flawed diamonds easier to sell.

The Clarity Gap: How EGL Bent the Rules

To understand why SI3 is such a problem, you first need to know how the official GIA scale works at the “Slightly Included” level.

- SI1 Clarity: Inclusions are noticeable under 10x magnification but are often “eye-clean” (not visible to the naked eye). A great value tier.

- SI2 Clarity: Inclusions are easily seen under magnification and may be visible to the naked eye. Careful selection is crucial here.

- I1 Clarity: Inclusions are almost always obvious to the naked eye and can threaten the diamond’s beauty and even its durability.

There is a huge drop in price and desirability between an SI2 and an I1. For sellers, I1 diamonds are tough to move. So, EGL created the “SI3” to act as a bridge.

It’s a marketing masterpiece. The grade takes a diamond that GIA would almost certainly call an I1 and gives it a label with the much more appealing “SI” prefix. For the average buyer, “Slightly Included 3” sounds a world away from “Included 1,” but in reality, they are almost always the exact same, visually flawed stone.

My Expert Advice: The Bottom Line on SI3 Diamonds

From my time in the trade, I can tell you that when I see an “SI3” grade on a diamond report, my internal alarm bells go off. It’s an immediate signal to be extremely cautious. It means you are looking at a diamond with flaws that are likely visible to the naked eye, even though the certificate is designed to make it sound better than it is.

The psychological trick is potent. You’re comparing what you think are two different levels of quality. You see the vast price difference between a GIA VS1 vs. a VS2 clarity diamond, so you assume an SI2 vs. an SI3 is a similar small step. It’s not. It’s a cliff.

One of the most frequent questions I get is, “What is the best diamond clarity?”. The answer always involves finding the lowest grade that is still eye-clean.

The purpose of the SI3 grade is to deliberately blur that line, fooling you into buying a visibly included diamond that has been given a more respectable-sounding name. It’s a solution for a seller’s problem, not a buyer’s.

💍 Limited Time: Forge your perfect ring! Get up to 20% OFF engagement ring settings at James Allen!

✨ Conscious Value: Save on brilliance! Lab-Grown Diamonds are now up to 10% OFF at James Allen.

🔥 Flash Sale:

Huge inventory blowout! Save

How an EGL Diamond Report Can Cost You Thousands

This is where the theory ends and the real-world financial damage begins. The entire business model of relying on lenient labs is built on a psychological trick I call “The Value Trap.” It’s designed to make you feel like a savvy shopper who’s found a loophole, when in reality, you’re the one being looped.

It’s the most dangerous trap in the diamond world because it preys on your logical instinct to compare prices. Let me walk you through exactly how it works.

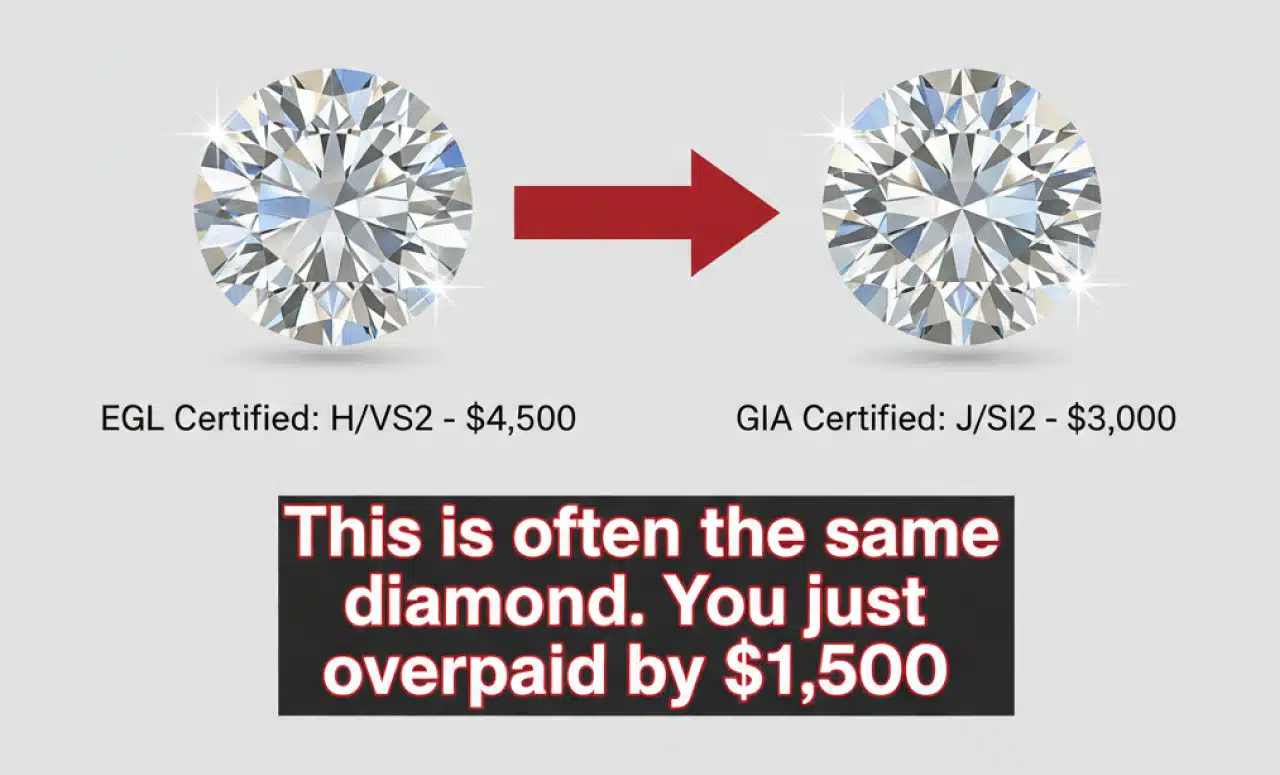

The Value Trap in Action: A Real-World Breakdown

Imagine you’re scrolling through a website. You have a budget and you’ve set your filters: you’re looking for a 1-carat diamond, H color or better, and a VS2 clarity or better.

Suddenly, a diamond pops up that stops you in your tracks.

- The Lure: A 1-carat round brilliant with an EGL diamond report. The grades are fantastic: H color, VS2 clarity. The price is $4,500.

Your heart quickens. You’ve seen GIA-certified diamonds with the exact same specs listed for over $6,000. This feels like a steal—a massive, $1,500+ savings for what appears to be the identical product.

This is the precise moment the trap is sprung.

Now, let’s get real. As we’ve discussed, an EGL report is an elastic ruler. Based on decades of industry data, that EGL-graded “H VS2” is almost certainly what the GIA would grade as a J color and an SI2 clarity—and that’s a conservative estimate. Sometimes, an EGL VS2 can even be an I1 or I2 clarity diamond, but let’s be generous for this example.

So, let’s search again, but this time for the actual quality of the diamond you’re looking at.

- The Reality: A 1-carat round brilliant with a GIA certificate. The grades are J color, SI2 clarity. The price is around $3,000.

Let the numbers sink in.

| Diamond | Certificate | Listed Grades | Actual Quality (GIA equivalent) | Price | The Result |

| The EGL Diamond | EGL | H Color, VS2 Clarity | J Color, SI2 Clarity | $4,500 | You Overpaid by $1,500 |

| The GIA Diamond | GIA | J Color, SI2 Clarity | J Color, SI2 Clarity | $3,000 | You Paid the Fair Price |

The bottom line is devastatingly simple: you didn’t save $1,500, you lost $1,500. You paid a premium price for a lower-quality diamond, all because its certificate presented a flattering, funhouse-mirror version of reality.

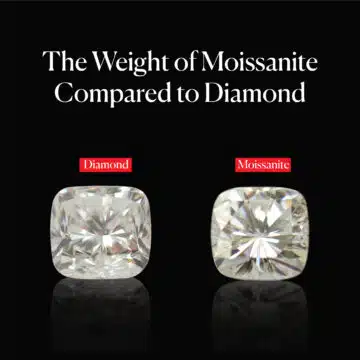

Visualizing the Deception

To show you this isn’t just theory, let’s look at a side-by-side example. The price difference between these stones is often justified by the seller as simply “a great deal.” It’s not. It’s the cost of grade inflation.

Why Trustworthy Certification is Non-Negotiable

This scenario is exactly why, as an industry professional, I can’t in good conscience recommend any certificate outside of the top-tier labs.

The risk of overpaying is just too high. While GIA is the global gold standard, other reliable labs enforce rigorous standards that provide a similar layer of protection.

The AGS grading system, for instance, is another world-class institution highly revered for its scientific approach, especially to cut grading. Other European labs like the HRD Diamond Certification authority exist, but they still don’t have the ironclad consistency of GIA in the global market.

And while IGI Diamond Certification has become a leader in the lab-grown diamond space, for natural diamonds, GIA remains the undisputed king of accuracy and trust.

When you purchase a diamond graded by one of these premier labs, like a G-color diamond from James Allen, you’re buying certainty. You know that the grade on that report is a fact, not an opinion—and that certainty is what separates a smart investment from a costly mistake.

Is EGL USA Certification Different from EGL International?

As you get deeper into your diamond search, you might hear a salesperson make a subtle but important-sounding distinction. If you question an EGL report, they might lean in and say, “Ah, but this is an EGL USA certificate, not EGL International. It’s much better.”

This is a classic sales tactic designed to soothe your anxiety and close the deal. And while there’s a historical sliver of truth to it, today, it’s a distinction without a meaningful difference. Let me explain why.

Should You Trust EGL USA or EGL International More?

The frank answer is: You shouldn’t trust either of them with your money.

Years ago, within the diamond trade, there was a quiet consensus. The EGL network, being a franchise, had labs of varying quality. The labs in New York and Los Angeles (EGL USA) were generally considered to be a bit stricter than their international counterparts.

On the other end of the spectrum, EGL Israel, for instance, had a reputation for being so lenient that their grading was almost meaningless.

So, if a jeweler had a diamond they knew would get a poor GIA grade, they might send it to EGL USA. If the stone was even lower quality, it might get sent to EGL Israel.

But focusing on this is like debating which leak in a sinking boat is the smallest. The entire boat is still going down.

Deal Alert: Ritani’s current promotions offer exceptional value.

Discount applied automatically

Shop Lab Diamonds | Shop Settings| Pro Tip: Ritani offers price matching and free shipping.

The Industry’s Final Verdict: The RapNet Delisting

You don’t need to get lost in the “he said, she said” of different labs. The professional diamond industry has already cast its final vote, and it was unanimous and brutal.

RapNet, the central global trading network where tens of thousands of dealers list and buy diamonds—essentially the stock market for the entire industry—made a decision. They were tired of the constant complaints and misrepresentation associated with EGL certificates.

So, they banned them. All of them.

They didn’t just delist EGL Israel. They didn’t just delist EGL International. They banned every single EGL report, including EGL USA, from their platform. This was a clear, unambiguous signal to the entire world: the risk of grade inflation across the entire EGL network was too great to tolerate.

My Expert Take on the EGL Civil War

The debate over which EGL lab is ‘better’ is like choosing the best tire on a broken-down car. The fundamental issue—unreliable grading—is the same across the board. You can polish a tire, but if the engine is shot, you’re still not going anywhere.

Arguing about the minor differences between EGL franchises is a distraction from the main point: your money is safest with a system built on consistency and trust from the ground up. That means GIA and AGS, period.

This dedication to a single, high standard is crucial everywhere in the industry. The best labs apply it to all types of stones, which is why we’re now seeing the GIA bring that same rigor with their new GIA lab diamond reports. When the standard is reliable, the origin doesn’t matter; the trust is already there. With EGL, that trust was broken, and it was never repaired.

People Also Ask: Your Top EGL Certification Questions Answered

When you’re trying to make a smart decision, it’s natural to have a lot of questions. Here are direct, no-nonsense answers to the most common queries I hear about EGL diamond certification.

Final Verdict: My Professional Advice on Buying an EGL Diamond

The Bottom Line: Do not buy an EGL certified diamond. I cannot be clearer on this. The peace of mind that comes with an independent, reliable certificate is the entire reason you pay for a graded diamond in the first place. EGL fails to provide that fundamental promise.

Let me say it again: you will almost always overpay for what you’re actually getting. The attractive price is not a deal; it’s a carefully constructed marketing trick that preys on uninformed buyers.

So, here is my final piece of advice: Forget the piece of paper and focus on what’s real. If a deal seems too good to be true, the certificate is always the reason why. A world-class diamond will always have a world-class report to back it up—no exceptions.

For a diamond you can be 100% confident in, one that you’ll be proud to own and pass down, stick to retailers who prioritize GIA and AGS certificates. Your search for a truly great diamond should begin and end at places like Blue Nile and James Allen.

And when you’re ready, get the best possible price with our curated list of Blue Nile promo codes and James Allen promotional codes.

Continue Your Research Journey

You’ve just completed one of the most important lessons in your entire diamond education. You now understand that a certificate isn’t just paper; it’s a shield. Knowing the difference between a strong shield (GIA) and a weak one (EGL) gives you a power that most buyers simply don’t have.

But your journey to becoming the smartest shopper in the room is just beginning. Take this newfound knowledge and apply it. These are the guides I’ve written to help you move forward with absolute confidence.

First, See This Knowledge in Action: The Head-to-Head Showdowns

Now you know the power of certification. Watch how it becomes the deciding factor in my bare-knuckle comparisons of the biggest names in the diamond world.

- See how an innovative online retailer compares to a new-age luxury brand in my Vrai vs. Blue Nile Review.

- Understand the difference between a massive inventory and a tech-forward approach in this Ritani vs. Blue Nile breakdown.

- Witness the ultimate online showdown in my comparison of Brilliant Earth vs. James Allen.

Next, Master the Diamond Itself: Shapes & Specifics

You know what makes a diamond trustworthy. Now find the shape and characteristics that make it yours.

- For the lover of modern, clean lines and subtle elegance: My definitive Emerald Cut Diamond Buying Guide.

- For the fan of elongated shapes and brilliant sparkle: The complete insider’s guide to the Oval Cut Diamond.

- For a bold, vintage-inspired look with a unique fire: All my secrets on mastering the Marquise Cut Diamond.

Finally, Get Answers to Your Most Pressing Practical Questions

Let’s arm you with the final pieces of information you’ll need to buy with total confidence.

- Start your journey from a place of power with my guide to the Best Places to Buy Engagement Rings Online.

- Want the biggest-looking diamond for your budget? I reveal the secrets in What Shape Diamond Looks the Largest?.

- Understand the one “flaw” that can sometimes be a feature: My deep dive into Diamond Fluorescence.